Bharat’s Digital Shift—Beyond Metro Mindsets

India’s digital story is often framed around metropolitan hubs and high-end enterprise tech. But the real, transformative wave is rising from smaller towns, rural districts and millions of Micro, Small & Medium Enterprises (MSMEs) operating in mixed offline-online environments. We term this ecosystem Semi-Digital India — where digital rails exist, yet usage adapts to local realities like patchy connectivity, low-cost devices, vernacular needs and trust-based physical commerce.

Key signals:

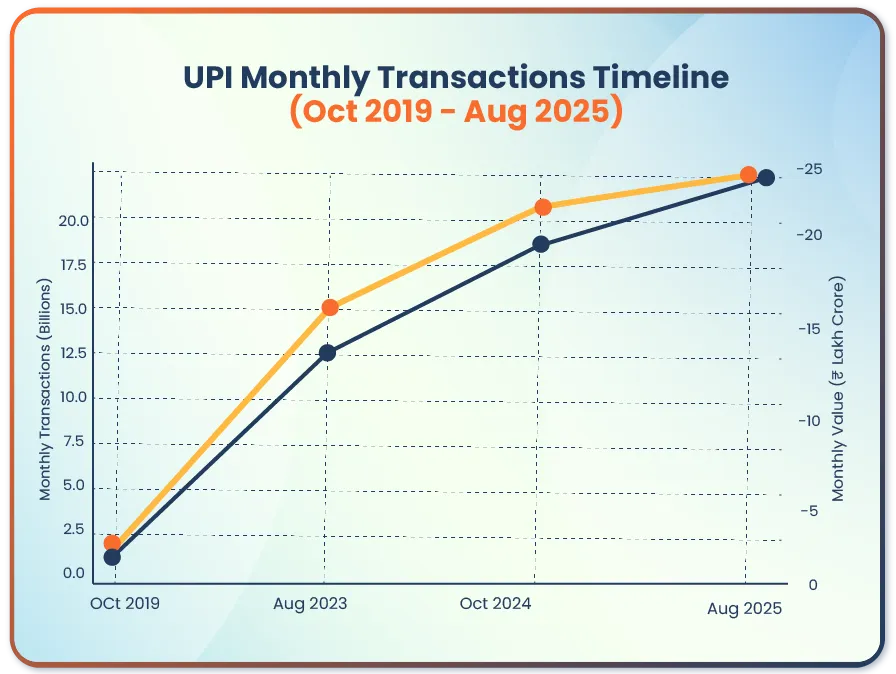

- In August 2025, India’s Unified Payments Interface (UPI) processed over 20 billion transactions worth ₹ 24.85 lakh crore. Source: The Economic Times

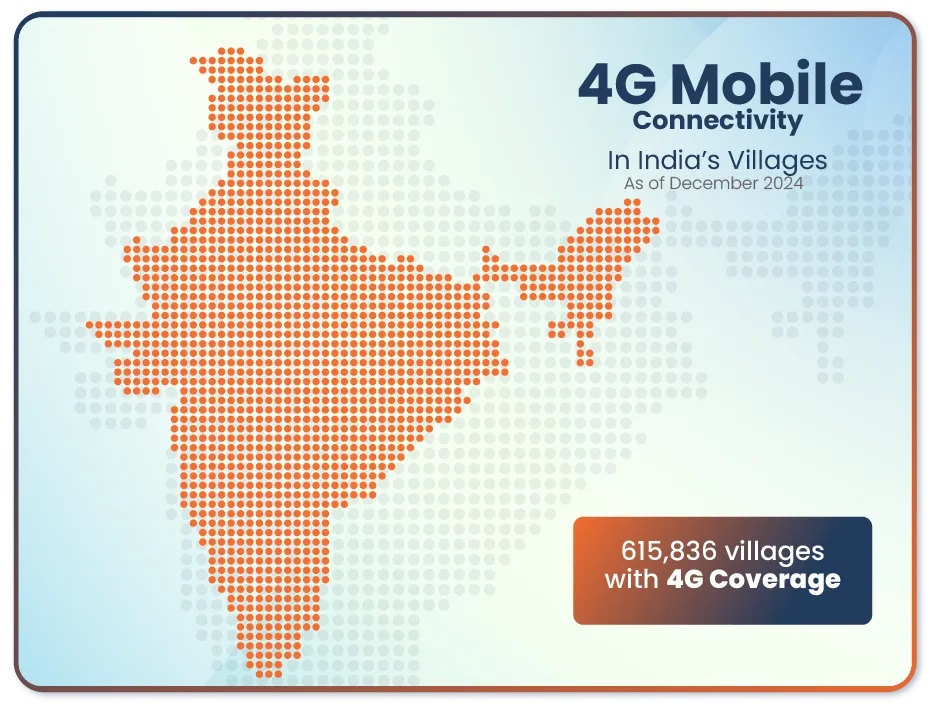

- As of December 2024, about 6.19 lakh villages were reported with 4-G mobile coverage. Source: Press Information Bureau

- Over 95 % of India’s villages (≈ 6,14,564 out of 6,44,131) now claim 4-G connectivity. Source: ETTelecom.com

This isn’t the future—it’s the present growth engine. It aligns squarely with Senrysa’s mission of building inclusive digital infrastructure and last-mile financial services.

What Makes Semi-Digital India Economically Powerful

Defining Semi-Digital India

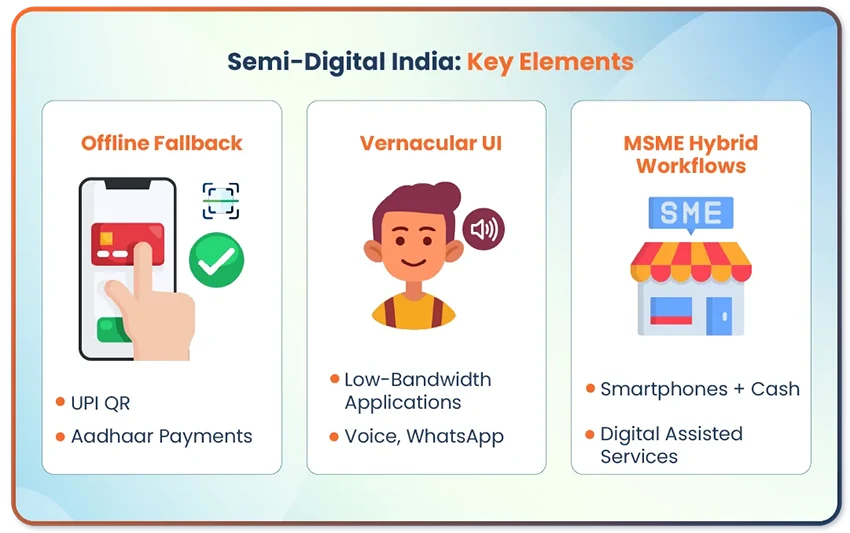

A functional hybrid system that comprises:

- Digital payments under offline / low-network conditions (e.g., UPI QR, Aadhaar enabled payments, SMS-OTP workflows)

- Low-bandwidth applications and vernacular UI (voice, WhatsApp-led workflows)

- MSMEs combining smartphones + cash + UPI + assisted digital services

This architecture fits Bharat’s connectivity, device & trust realities — no assumption of always-on broadband.

Why It Matters

Adoption of semi-digital practices accelerates inclusive growth by enabling MSMEs to:

- Accept digital payments at low cost

- Access credit and broader markets

- Build digital identity/trail for themselves

- Improve operational efficiency and revenue

This forms fertile ground for Senrysa’s hybrid digital solutions to scale.

Hybrid Infrastructure: Backbone of Semi-Digital Bharat

- Internet connections grew from ~251.5 million (2014) to ~969.6 million (2024) in India. Source: Press Information Bureau

- Rural tele-density (connections) now exceeds 527 million. Source: Press Information Bureau

- Foundational rails such as UPI, Aadhaar, ONDC, DigiLocker are now in play — enabling semi-offline transactions.

Senrysa has been advancing this model via last-mile banking, Aadhaar authentication and agency-banking platforms.

UPI: Entry-Point to Bharat’s Digital Economy

- 48 % of MSMEs now prefer UPI for business payments. (Industry surveys)

- 39 % use Aadhaar-enabled banking workflows.

- 73 % report income or efficiency gains from digital adoption.

UPI introduces trust and digital habit—paving the way to inventory, credit scoring, online marketplaces and assisted commerce. Senrysa’s payments & AEPS systems align naturally with this journey—from assisted digital to autonomous digital.

Semi-Digital Benefits for MSMEs

- Low cost of adoption (QR sticker + smartphone)

- Fast ROI (efficiency gains + better collections)

- Inclusive employment via assisted digital kiosks and agents

- Smartphone adoption among rural women-led MSMEs is ~84 % in some studies.

These benefits align with Senrysa’s branchless banking & last-mile models.

Public Infrastructure Enabling Semi-Digital Bharat

Connectivity

As of December 2024, approx. 6.19 lakh villages had 4-G mobile connectivity. Source: Press Information Bureau

Digital Identity and Rails

Platforms such as Aadhaar, DigiLocker, e-KYC provide foundational trust and compliance rails — networks Senrysa leverages for secure citizen services and MSME access.

Challenges and Senrysa’s Solutions for Semi-Digital Adoption

| Challenge | Senrysa Solution |

| Intermittent / low network connectivity | Offline-first models (cache-sync, SMS fallback) |

| Digital literacy & vernacular UX gaps | Assisted digital models, vernacular UI & agent-led onboarding |

| Trust & regulation concerns | Aadhaar-powered authentication, compliance frameworks |

| MSME onboarding cost & fragmentation | Shared infrastructure, micro-financing schemes |

These are real constraints—but addressable with hybrid models, which are Senrysa’s forte.

How Senrysa Powers Semi-Digital Bharat

Hybrid MSME Payments & Banking

- UPI + AEPS + offline fallback

- Micro-merchant onboarding via agents

- Assisted digital account opening & e-KYC

ONDC & Rural Commerce Integration

- Onboard Bharat sellers into broader digital commerce networks

- Inventory & fulfilment support

- Offline-first commerce workflows

Digital Public Services & Healthtech

- Telemedicine and diagnostic kiosks in semi-urban/rural hubs

- Government service delivery via assisted endpoints

- Welfare-distribution systems across hybrid networks

Capability Building & Micro-Financing

- Digital-literacy training and micro-entrepreneur skilling

- Merchant & agent financing models

- Aadhaar-verified micro-credit trails

Senrysa combines physical reach + digital infrastructure — enabling trust, compliance & scale for Bharat’s emerging economy.

Scaling the Semi-Digital Engine: The Way Forward

Priority pathways include:

- Infrastructure investment (rural backhaul, satellite, mesh networks)

- Vernacular & voice-first UX design

- Incentives for connectivity and MSME onboarding

- Strong identity, data safety & compliance rails

- Continuous adoption dashboards + field-data loops

Semi-digital India is scaling fast—and Senrysa is positioned as a catalytic infrastructure enabler in this transformation.

Conclusion: Why Semi-Digital India is Our Biggest Opportunity

Semi-Digital India represents the largest inclusion and growth wave in India’s digital economy. It blends offline trust with digital speed—reflecting how Bharat truly operates.

Senrysa sits at the core of this shift—building bridges across citizens, financial rails, government services and MSMEs though hybrid digital public infrastructure and financial systems.

This isn’t about the future—it’s live now. Senrysa will continue leading at the intersection of innovation, access and socioeconomic empowerment.