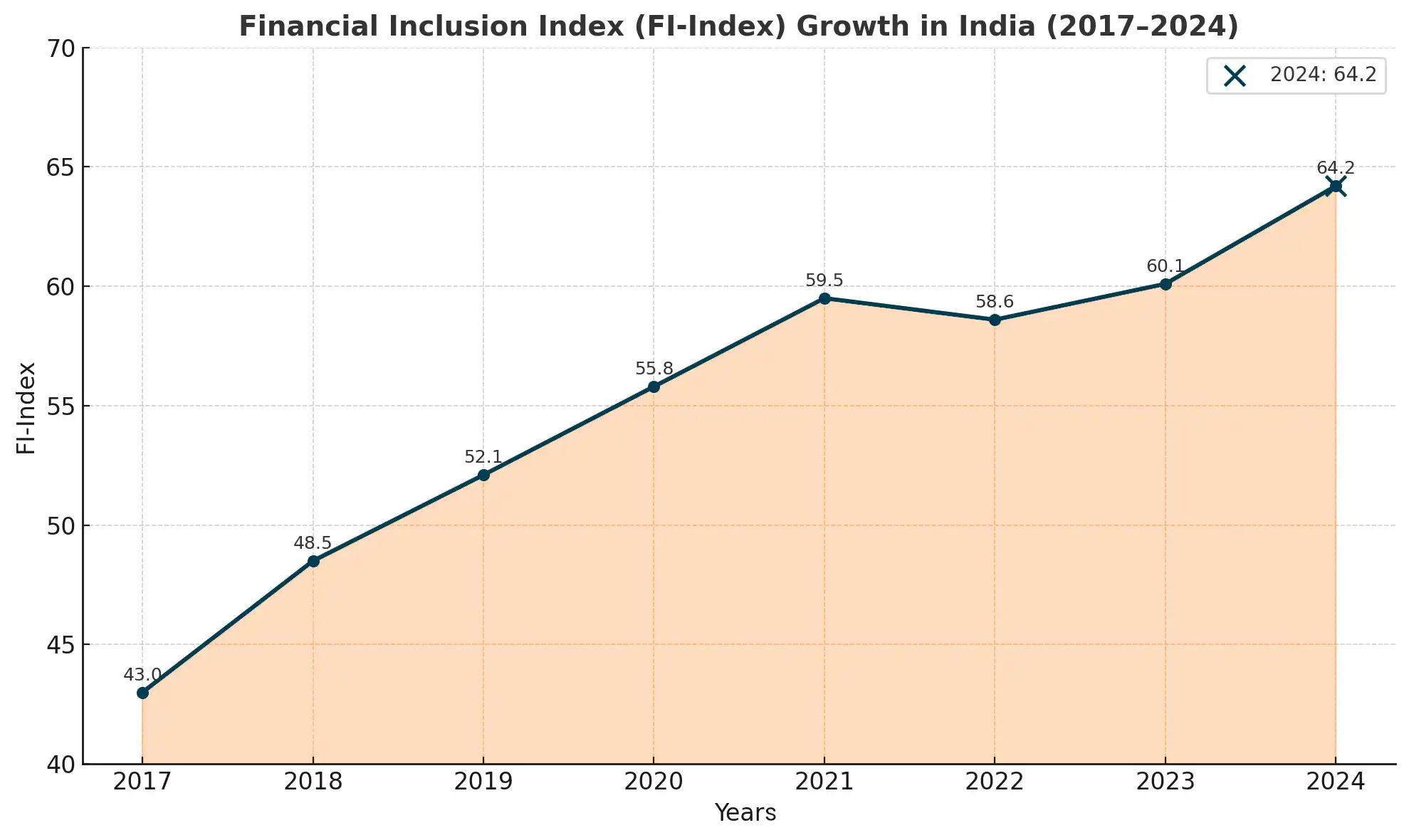

Financial Inclusion in India is a cornerstone of economic development and social empowerment, particularly in rural regions. It ensures that individuals and businesses, regardless of their location or income levels, have access to essential financial services. As of March 2024, India’s Financial Inclusion Index (FI-Index) reached 64.2, up from 60.1 in the previous year, demonstrating substantial progress in expanding banking access (Source: Reserve Bank of India). However, millions in rural areas still struggle to access formal financial services due to infrastructural gaps, digital illiteracy, and geographic barriers.

FinTech innovations are now reshaping the future of Financial Inclusion in India, and Senrysa Technologies is at the forefront of this transformation. By leveraging AI-driven banking, mobile-based financial solutions, and Aadhaar-enabled payment systems, Senrysa is revolutionizing branchless banking in India. Their mission is to ensure seamless financial access and empower underserved communities. Through its scalable and inclusive solutions, Senrysa is redefining Financial Inclusion in India, bridging the urban-rural divide, and contributing to sustainable development across the country.

The Need for Financial Inclusion in Rural India

Challenges Hindering Financial Inclusion

Despite various government initiatives and technological advancements, several challenges still hinder comprehensive financial inclusion:

Large Unbanked Population – Over 190 million Indians remain unbanked, making India the second-largest unbanked population globally (Source: World Bank, 2023). Many lack access to savings accounts, credit facilities, and insurance, making them vulnerable to financial risks.

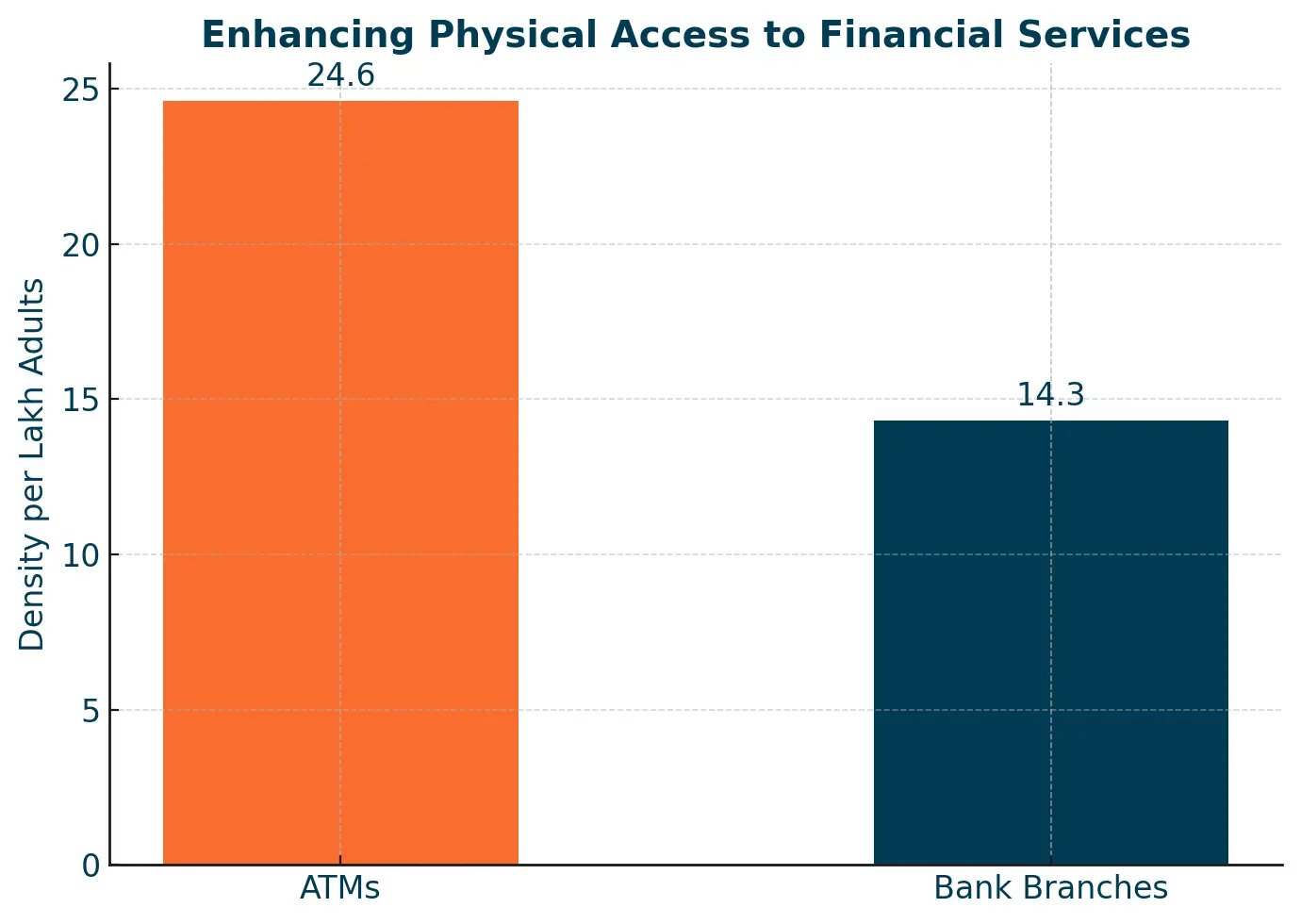

Barriers to Traditional Banking – Rural areas suffer from poor banking infrastructure, with less than 10% of villages having a bank branch (Source: NABARD). Limited ATM access, geographic remoteness, and low financial literacy further restrict access to financial services.

Dependence on Informal Lenders – Without formal banking access, rural entrepreneurs and farmers often resort to informal moneylenders, who charge interest rates exceeding 40% annually, leading to perpetual debt cycles.

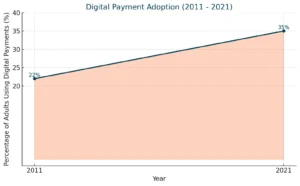

Limited Digital Financial Adoption – Despite over 1.2 billion mobile connections, digital financial literacy remains low, restricting the use of mobile banking and digital payments among rural populations.

How Senrysa is Transforming Financial Inclusion in India

Branchless Banking in India

Senrysa’s branchless banking model eliminates the need for physical branches by leveraging Business Correspondents (BCs) and digital platforms:

Micro ATMs – Senrysa has deployed over 50,000 micro-ATMs nationwide, providing cash withdrawals, deposits, and balance inquiries in rural regions.

Aadhaar Enabled Payment System (AePS) – This biometric-based platform has processed over ₹1.8 trillion transactions in India (Source: NPCI, 2024).

Digital Banking Kiosks & Agent Networks – With over 3,000 rural franchisees and a target of 5,000 by 2026, Senrysa is deepening financial inclusion in India.

Digital Payments & Mobile Banking

Senrysa promotes cashless transactions through UPI-based payments, QR codes, and mobile wallets:

UPI Transactions in India crossed ₹18.3 trillion in March 2024, showcasing rapid digital payment adoption (Source: NPCI).

Contactless Banking – Senrysa’s mobile-first banking solutions provide seamless financial services to rural populations, ensuring real-time transactions.

AI-Driven Credit & Lending Solutions

Access to credit is a major challenge for rural entrepreneurs. Senrysa is democratizing credit access through AI-powered credit assessments:

Instant Micro-Loans – AI-based credit scoring has enabled microloans worth ₹10,000 crore to be disbursed to farmers and small businesses.

Alternative Credit Scoring – Senrysa uses non-traditional financial data to evaluate creditworthiness, facilitating quick and hassle-free loan approvals.

Direct Benefit Transfer (DBT) Facilitation – Ensuring government subsidies and welfare benefits reach beneficiaries directly, reducing fraud and leakages.

Empowering Rural Entrepreneurs & MSMEs

Senrysa collaborates with government programs and financial institutions to provide working capital to over 1 million MSMEs, fostering economic growth and self-sufficiency in rural areas.

Government & FinTech Collaborations

Senrysa plays a key role in several government-led initiatives:

Pradhan Mantri Jan Dhan Yojana (PMJDY) – Supporting over 510 million new bank accounts opened since its inception.

AI-Driven Credit Assessment for Welfare Schemes – Assisting government agencies in efficient financial aid disbursement.

Financial Literacy Programs – Conducting over 5,000 training workshops, educating rural populations on digital banking and secure financial practices.

The Future of Financial Inclusion in India

Key Trends Shaping Rural Banking

AI and Blockchain Integration – AI-powered financial services and blockchain-backed transactions will enhance security, transparency, and efficiency in rural banking.

5G-Powered Mobile Banking – With India’s 5G expansion, mobile banking will witness unprecedented growth, ensuring deeper rural penetration.

Neo-Banks & Digital-Only Banking – The rise of digital-first banks will eliminate traditional barriers, offering personalized financial solutions.

Rising Financial Literacy – Senrysa is actively investing in financial education programs, ensuring that digital banking tools are widely adopted in rural areas.

Conclusion

The landscape of financial inclusion in rural India is evolving rapidly, with FinTech innovations playing a pivotal role in transforming banking accessibility. Senrysa Technologies, through its AI-driven banking solutions, digital payments, and Aadhaar-enabled authentication, is revolutionizing branchless banking in India.

With strategic collaborations between governments, financial institutions, and FinTech companies, the future of financial inclusion in India looks promising. As rural banking infrastructure strengthens and digital financial literacy rises, every individual, regardless of location or economic status, will have access to secure, inclusive, and empowering financial services.

Senrysa Technologies is shaping a future where financial inclusion is not a privilege but a fundamental right for all.