Introduction: The Digital Awakening of Rural India

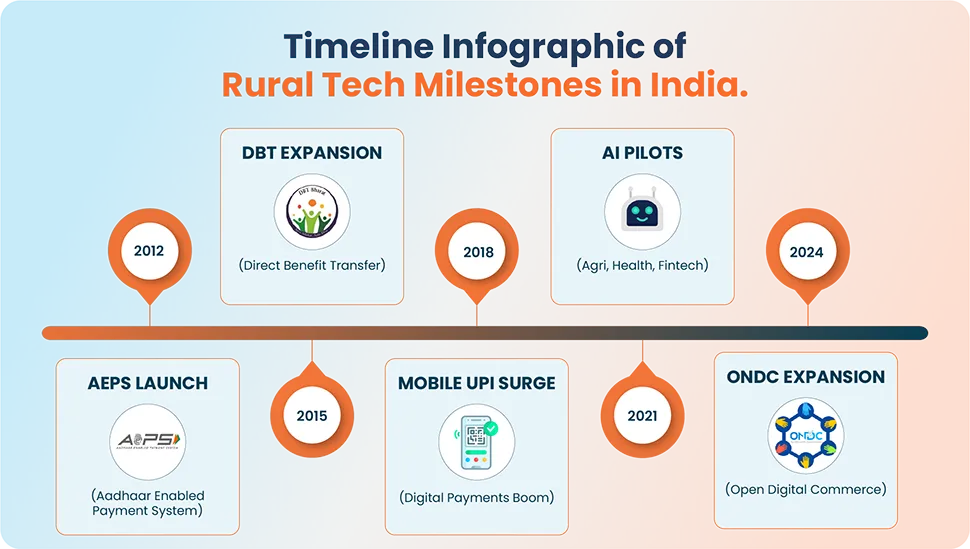

India’s villages—once considered digitally excluded—are now becoming centers of innovation. What began with Aadhaar-based authentication and AEPS (Aadhaar Enabled Payment System) has evolved into a thriving ecosystem of digital commerce, mobile penetration, and AI-driven solutions.

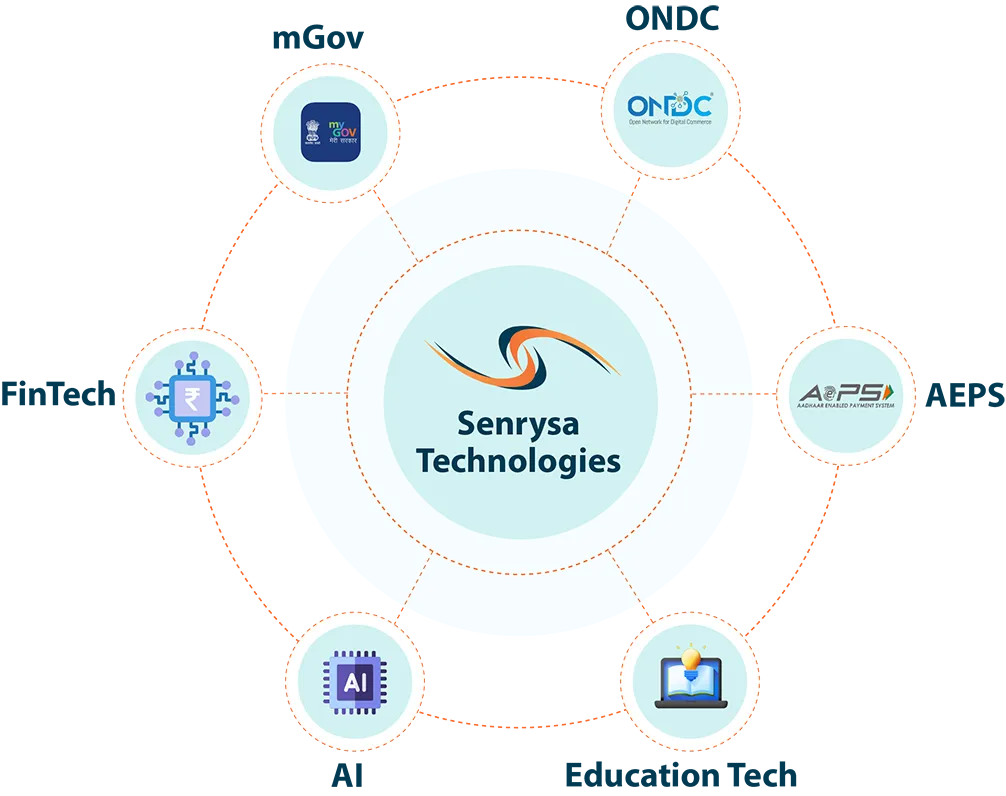

This transformation is not accidental. It is the result of government initiatives like BharatNet and Digital India, coupled with private innovations from solution providers such as Senrysa Technologies. Together, these forces are creating inclusive digital infrastructure that empowers India’s 800+ million rural citizens.

AEPS – The First Digital Lifeline for Rural India

What is AEPS and Why It Mattered

Launched by NPCI, AEPS linked Aadhaar with banking services, enabling biometric-based cash deposits, withdrawals, and balance inquiries. For millions, it was their first step into formal financial inclusion.

Benefits for Rural India:

- Banking without debit cards or smartphones

- Biometric authentication ensured security

- Doorstep banking through business correspondents

Senrysa’s Role in AEPS Rollout

Senrysa Technologies pioneered AEPS adoption at scale, powering 1.5+ billion rural transactions. By integrating banks, government agencies, and last-mile agents, Senrysa gave millions of rural citizens their first digital financial identity.

Senrysa’s AEPS platform provided the first financial identity to millions. – Ministry of Rural Development, Govt. of India

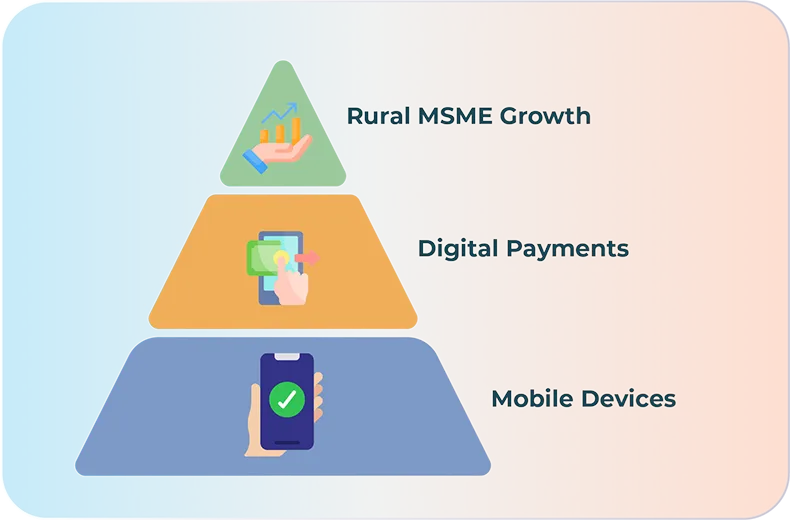

The Rise of Mobile-First Rural Commerce

Smartphones as Growth Catalysts

With affordable smartphones and widespread mobile penetration, rural consumers skipped desktops entirely and embraced a mobile-first economy—from UPI payments to online shopping.

Empowering MSMEs and Kirana Stores

Rural entrepreneurs now leverage cost-effective edtech and fintech tools:

- Unified payment gateways (UPI, AEPS, QR, cards)

- Mobile POS devices for small merchants

- Digital ledger and inventory apps

Rural Governance Goes Digital

e-Governance That Reaches the Last Mile

Programs like Digital India, eGramSwaraj, and PMGDISHA enable citizens to access land records, ration data, pensions, and certificates online.

Senrysa’s Governance Impact

Senrysa’s modular e-Governance platforms—integrated with Aadhaar, DBT, and CSC—delivered:

- 98% success rate in DBT payouts (Assam, Jharkhand)

- Real-time beneficiary authentication

- Reduced corruption and leakages in subsidy schemes

AI and Data Analytics: Driving the Next Leap

How AI Is Solving Rural Challenges

- AgriTech: Predict crop yields, weather forecasts

- HealthTech: Rural diagnostics with computer vision

- FinTech: Microcredit scoring & automated loan approvals

- EdTech: Adaptive learning in vernacular languages

Senrysa’s AI Innovations

- Satellite + soil data models for farming

- AI-driven financial health checks for SHGs

- Low-cost diagnostic tools for rural clinics

Digital Commerce – ONDC Empowers Rural Sellers

From Mandis to Marketplaces

With ONDC (Open Network for Digital Commerce), local artisans and sellers can bypass traditional e-commerce giants and sell nationally.

Senrysa + ONDC Impact

Senrysa builds ONDC integration platforms for:

- Digital catalog creation

- Order & payment management

- Fulfillment & logistics support

Case Study: A tribal weaver from Odisha saw 300% sales growth after joining ONDC via Senrysa’s platform.

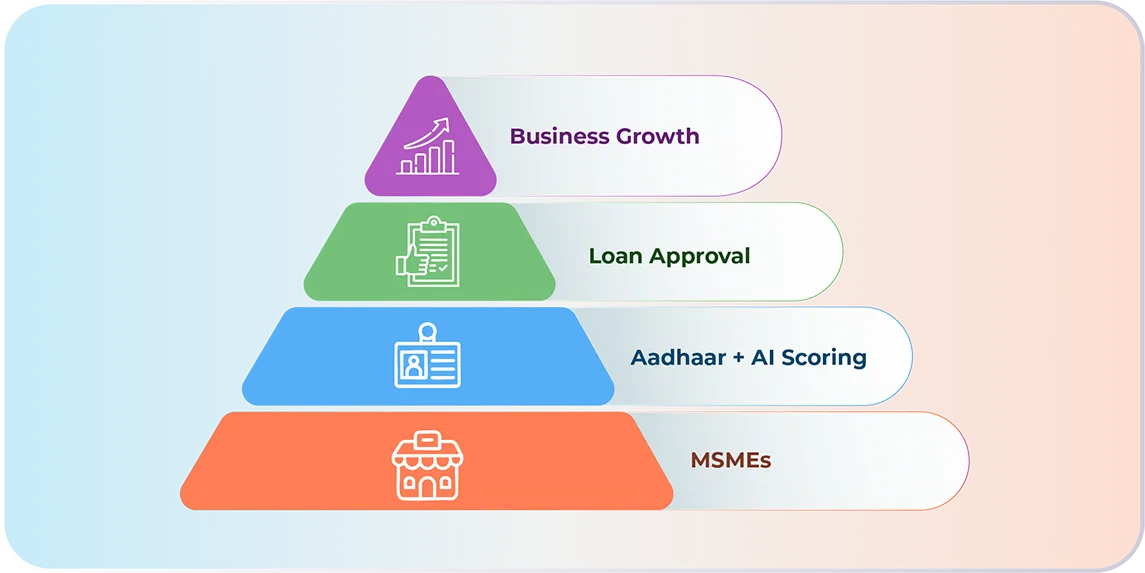

Bridging the Rural Credit Gap with Fintech

The Challenge

Over 75% of rural MSMEs lack access to formal credit, mainly due to collateral or documentation gaps.

Senrysa’s Digital Lending Models

- Instant loans via Aadhaar-based e-KYC

- Alternate credit scoring using mobile & transaction data

- ₹150+ crore disbursed through Senrysa’s rural credit engines

Challenges That Remain

- Digital Illiteracy – Many first-time users struggle with platforms

- Connectivity Gaps – Despite BharatNet, internet blackspots persist

- Trust Barriers – Communities adapt slowly to new tech

Senrysa’s Approach

- Vernacular-first interfaces

- Offline-enabled apps

- Community-led digital literacy programs

The Future – Bharat 2.0 Powered by Tech

By 2030, rural India could see:

- AI-powered farms & clinics

- Universal access to affordable classroom electronics

- MSMEs running on digital ERP

- End-to-end e-governance at every panchayat

Conclusion: A New Digital Chapter for Bharat

The journey from AEPS to AI reflects how rural India evolved from basic financial access to advanced innovation. With digital infrastructure, Aadhaar-based systems, ONDC marketplaces, and AI-powered inclusion, the heartland is no longer a laggard—it’s a growth engine.

Senrysa Technologies stands at the forefront of this change, bridging rural gaps with inclusive, cost-effective, and scalable digital solutions. From farmers to artisans, from students to MSMEs, Senrysa is writing the code for Digital Bharat 2.0.

Ready to power your rural transformation? Partner with Senrysa Technologies—Where Innovation Meets Inclusion.