Introduction: A New Dawn for Rural Finance

Financial inclusion in India has evolved dramatically—moving from basic access to bank accounts, to today’s AI-driven fintech solutions that are transforming rural lives. For decades, Rural Bharat struggled with challenges such as limited banking infrastructure, low digital literacy, and fragmented service delivery.

Now, with the advent of artificial intelligence (AI), a powerful shift is underway. This blog explores how AI is revolutionizing financial inclusion in rural India—and how Senrysa Technologies is playing a pioneering role in this transformation.

The Evolution of Financial Access in Rural Bharat

The Leap from Basic Banking to Smart Credit

Initiatives like PMJDY gave millions of rural citizens their first bank accounts. But true financial inclusion is about meaningful access, not just account numbers. AI is enabling this leap by providing:

- Instant micro-loans based on non-traditional credit signals

- Virtual branchless banking through micro-ATMs

- Personalized financial literacy tools in local languages

Senrysa has deployed 50,000+ micro-ATMs and enabled ₹1.8 trillion in AEPS transactions, ensuring secure access for rural communities.

AI-Powered Credit Solutions: Trust Redefined

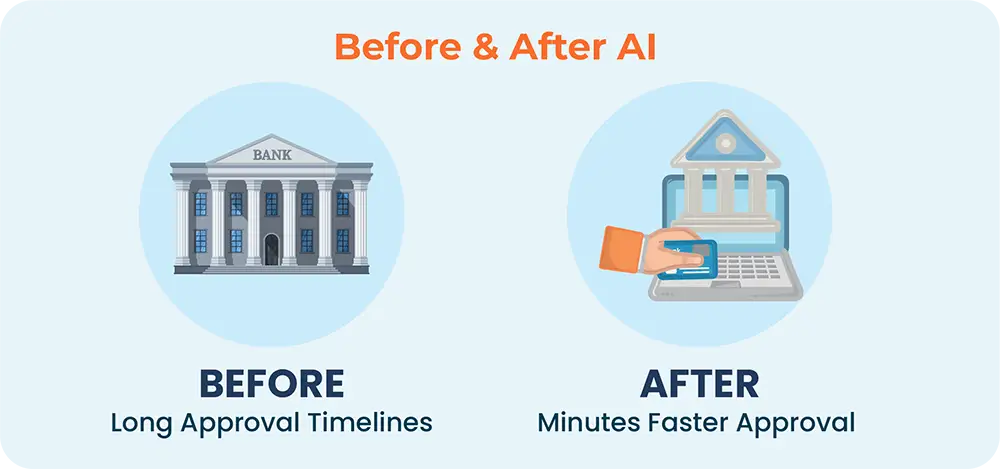

From Bank Credit to Algorithmic Credit Approval

Traditional banking often excludes rural borrowers due to lack of documents or collateral. AI solves this by:

- Analyzing alternate data (mobile usage, transaction history, social signals)

- Approving loans in minutes, not weeks

- Reducing risks for lenders while expanding access

Senrysa’s AI-driven credit engine has already disbursed ₹10,000 crore in micro-loans, benefiting small businesses and farmers.

Smarter Payments with Intelligent Video Analytics

Secure, Inclusive, and Fraud-Free

Fraud prevention is as critical in villages as in cities. With AI-powered analytics in micro-ATMs and kiosks:

- Tampering is detected in real-time

- Biometric authentication is validated instantly

- Transaction flows are continuously monitored

This ensures that rural financial access is not only inclusive but also secure.

AI-Enhanced Financial Literacy and Support

Personalization Meets Vernacular Delivery

Financial adoption in villages is often hindered by low literacy. AI bridges this gap with:

- Chatbots & voice bots in local languages

- Interactive guides for first-time users

- Community-based workshops

Senrysa has conducted 5,000+ financial literacy workshops and integrated AI voice assistants into micro-ATM systems to simplify banking for rural citizens.

AI in Insurance, Payments & Welfare Schemes

AI is driving personalized financial products at scale:

- Micro-insurance claims under PMJJBY via biometric verification

- AI fraud detection in government subsidy delivery

- Smart payouts ensuring benefits reach the right recipients

Senrysa’s compliance solutions integrate with PMJDY, AEPS, and DBT, making welfare schemes efficient and transparent.

AI and Financial Ecosystems – Building Rural Fintech

Neo-Banking at the Last Mile

Rural India is embracing neo-banking models powered by AI, offering:

- Voice-based banking services

- Personalized budgeting tools

- Small-scale investment education

While not branded as a neo-bank, Senrysa’s white-label platform powers agent-based banking and fintech services in the remotest regions.

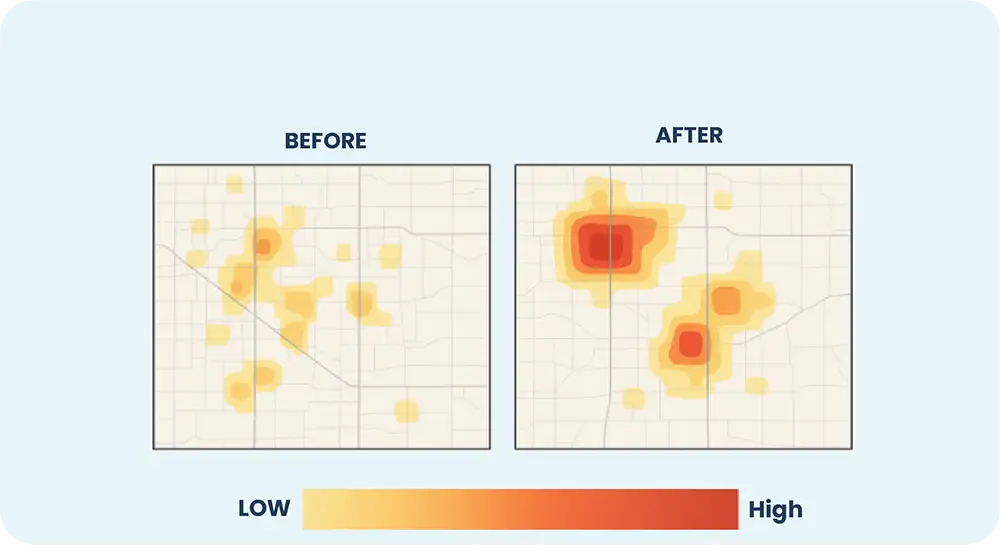

AI Analytics for Inclusive Rural Ecosystems

Data-driven AI enables smarter decision-making:

- Optimizing micro-ATM placement

- Tracking customer lifecycles

- Nudging financial literacy adoption

Senrysa offers ML-based dashboards and insights to partner banks and MFIs, ensuring smarter interventions for maximum impact.

Overcoming Challenges in Rural Financial Inclusion

Despite progress, barriers remain:

- Poor internet connectivity

- Digital mistrust, especially among elders

- Literacy gaps

Senrysa tackles these with:

- Offline-capable AI

- Multilingual, voice-guided interfaces

- Community training via its BC (Business Correspondent) network

The Road Ahead: Future of AI in Rural Finance

The next wave of innovation includes:

- Voice-first microfinance for non-literate users

- AI-powered investment advice for rural investors

- Image-based crop insurance claims via smartphones

- Real-time fraud detection using behavioral AI

Senrysa is already piloting voice banking and rural investment advisory services, preparing for a next-gen financial ecosystem.

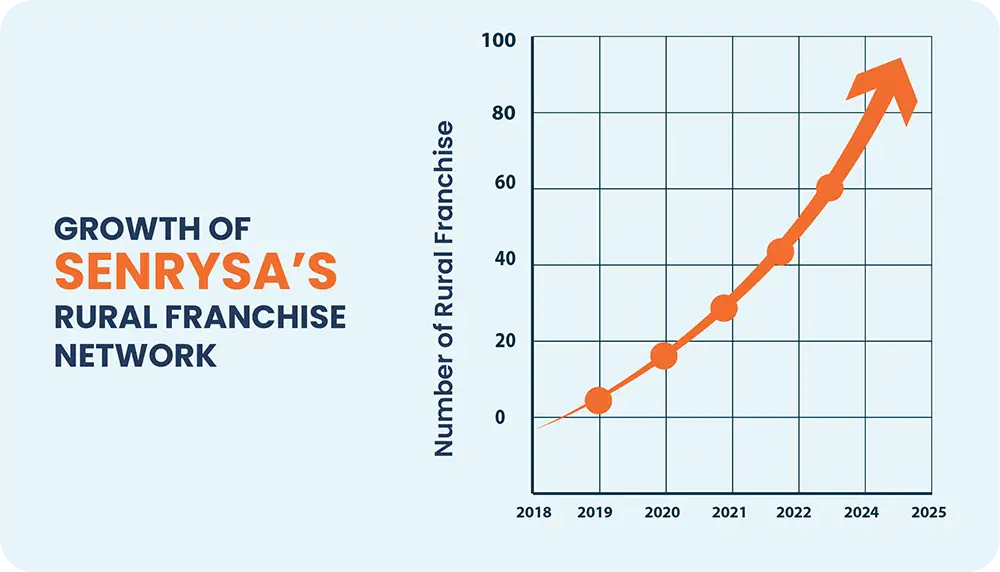

Why Senrysa is a Game-Changer

- Tailored for low-infrastructure environments

- Interfaces in regional languages

- Trust-first design via local agents

- Network of 3,000+ rural franchises, expanding to 5,000+

Measuring Impact — Numbers That Speak

- ₹1.8 trillion in AEPS transactions

- 50,000+ micro-ATMs deployed

- ₹10,000 crore in AI-driven micro-credit disbursed

- 5,000+ literacy workshops conducted

These figures prove that AI is not just innovation—it’s impact at scale.

Conclusion: A Brighter Future for Rural Bharat

By combining AI capabilities with inclusive fintech, India is closing its rural-urban financial divide. From biometric payments to intelligent micro-loans, AI ensures financial inclusion is no longer aspirational—it’s actionable.

Senrysa Technologies stands at the forefront of this transformation, empowering rural India with access, education, and security.

As Rural Bharat embraces AI-powered fintech, one thing is clear—AI is not just technology; it is a lifeline for millions, enabling dignity, opportunity, and growth.